Get a 10-24+% Projected Annual Return on your Investment

The average annual return of REITs is 11.8%*. With renest capital, you can expect a 12-24% annual return, depending on whether you

invest in equity or debt. No snake oil. No BS. No empty promises.

Just honest investors putting your money to work for you.

invest in equity or debt. No snake oil. No BS. No empty promises.

Just honest investors putting your money to work for you.

Click the button above to see if you qualify as an accredited investor.

We’re Currently Invested in:

Name: Common Equity – Series 1A

Location: Florida

Potential return: 10%

Term: 12 months

Name: Preferred Equity – Series 1B

Location: Florida

Potential return: 12%-14%

Term : 24 months

15+

Years Experience in

Real Estate

Real Estate

$24M

Assets Under

Management

25+

Investors

Reduce your risk with

our diverse investment portfolio

When you invest in renest capital, you can choose to invest in a single property (with an equity investment) or our entire real estate fund (with a debt investment). You can also make a debt/equity investment.

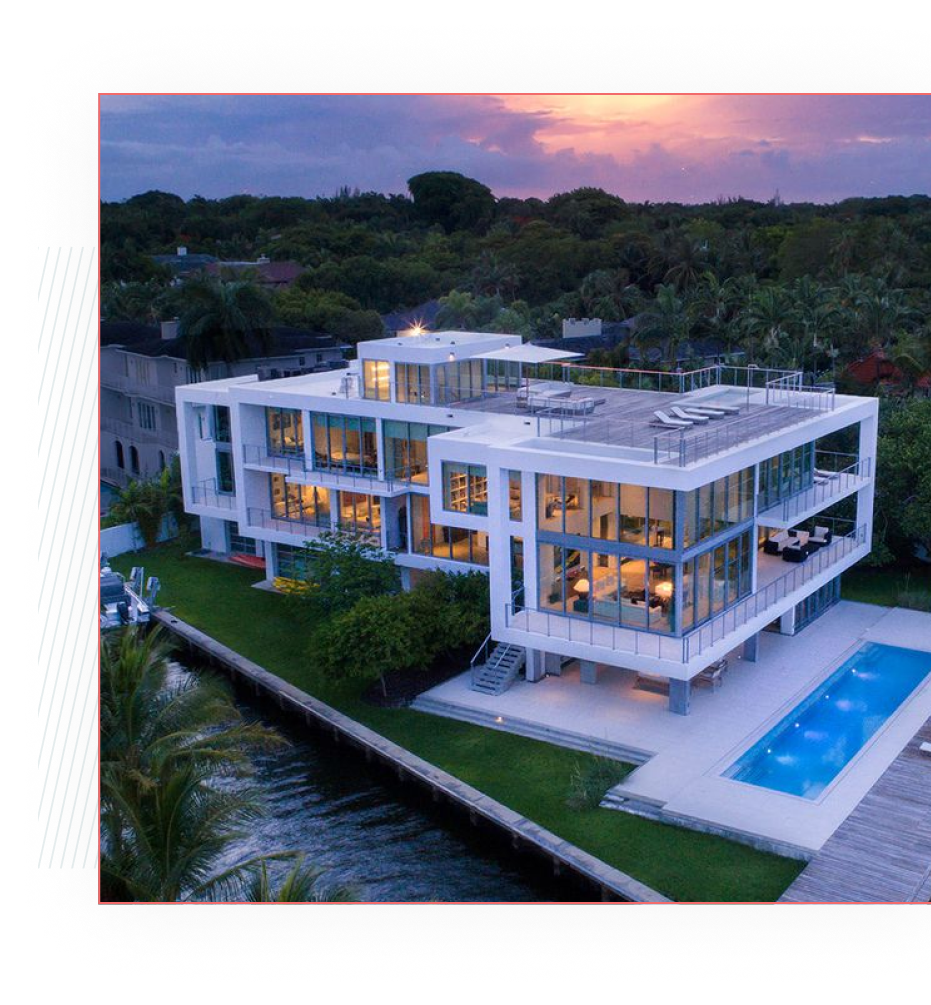

Our diverse real estate portfolio is made up of:

- single family home rehab and development

- multi-family apartment buildings

- commercial properties

- flex properties (hybrid of office and industrial)

By investing in a diversity of assets, you can spread your money across different locations, property types, and market segments. Which will help you reduce your risk overall. And improve returns.

Your money is safe with us

We’ve never lost

money on a deal

To date, we’ve invested in 100+ properties

– and never lost money on a deal.

– and never lost money on a deal.

We’re 506c accredited

by the SEC

To date, we’ve invested in 100+ properties – and never lost money on a deal.

We make data-backed

decisions

To date, we’ve invested in 100+ properties – and never lost money on a deal.

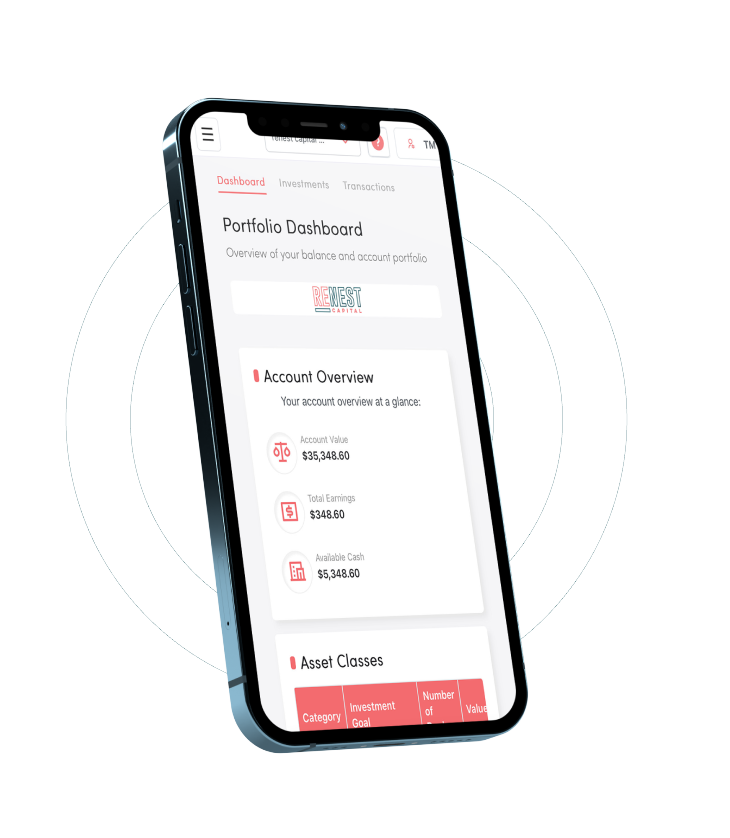

Your Investment is housed inside a secure, third-party platform, avestor. You can track your investment anytime simply by logging into your account.

Get Frequent Project Updates

When you invest in renest capital, you’ll never wonder “how are those projects coming along?” or “Where did

my money go?” Because we’ll keep you updated every step of the way.

my money go?” Because we’ll keep you updated every step of the way.

Monthly Zoom®

Calls

Once a month, we’ll hop on a 30-minute Zoom call (along with approximately 10-15 other investors). On the call, we’ll go over the projects you’re invested in, how they’re coming along and any next steps.

Monthly the flipside Newsletter

As a renest capital investor, you’ll get a monthly newsletter with status updates on all the real estate projects. So you can see how each one is progressing. And how each one has exited (gross profit).

Anytime Texting

Got a question or concern about something?

You can text us anytime.

You can text us anytime.

A few (more) reasons why you'll be happy you invested

in renest capital

We do all the heavy lifting, so the money you make through renest capital is 100% passive.

The average annual return of REITs is 11.8%. With renest capital, you can expect a 12-24%+ annual return (depending on whether you invest in equity, debt or both).

If you’re a debt investor, you’ll get monthly or quarterly distributions (no matter how a project performs).

If you’re an equity investor, you’ll get paid once we make a profit.

Since the value of property tends to rise over time, real estate investments can protect you against inflation.

On top of that, we keep a close eye on market conditions. And if needed, we adjust the fund’s investment strategy and make tactical asset allocation decisions to reduce the impact of inflation on the fund’s performance.

A “profitable” deal doesn’t cut it for us. We only invest in a deal if we’re confident that it will result in crazy high ROI.

How do we do that?

Well, from an equity side, we invest in real estate projects managed by industry leaders in their respective asset classes. Experienced sponsors who have been in business for at least 10 years and have taken investments full cycle. For example, buying the land, raising the capital, constructing the property, leasing the units and then exiting.

We partner with sponsors who are aligned and experienced in all areas of real estate investing: finance, accounting, construction and compliance.

These are just a few questions we ask ourselves before partnering with a sponsor:

Do they do their homework before doing a deal?

There are a lot of sponsors out there who blindly invest in deals. But not the ones we partner with.

Do our underwriting models align?

Do they underwrite deals depending on the market conditions and constraints? Or do they promise only rosy returns without taking into account the market conditions?

Do our distribution models align?

We pay our own investors monthly or quarterly depending on what is listed in the deal agreement.

Do they target the same geographies?

We aren’t going to do a deal in the middle of Kansas. We only do deals where there is significant economies of scale, rent growth and population growth.

How stable are their assets?

Are there fluctuations that may come about as a result of the market changing? This is where data helps guide our decisions.

Do we have the same timelines for exit (when the property will sell)?

Our goal is to sell as quickly as possible to maximize profit.

Hey, I’m Tony! CEO And Founder Of renest capital

Before becoming the Principal for the renest capital, I worked in Corporate America for 25 years. Where I managed large commercial sales teams and ran budgets of $13M+.

Let’s put it this way: I’m not just a guy who decided one day to invest in real estate.

I know finance. I know how to manage money. And most importantly, I know how to get a return on your investment.

What type of investment is right for you?

You can make a debt or equity investment (or both).

Choose which one is right for you.

Choose which one is right for you.

Debt

Targeted 12-18% annual return

Equity

Targeted 17-24% annual return

In this case, you lend money to a real estate project or property owner and become a creditor. You’ll receive regular interest payments, on top of the principal amount owed.

As an equity investor, you purchase a stake in the real estate project or property and become a partial owner. You’ll typically receive a share of the property’s profits or cash flows, as well as potential appreciation in the property’s value.

Income

You generally have a fixed income stream paid every month or quarter, no matter how much money we make.

You don’t have a fixed income; instead you make money when renest capital makes money.

Return

Targeted 12-18% annual return

Targeted 17-24% annual return

Risk

In case of default, you will have a higher probability of getting your money back compared to equity investors.

Equity investments are higher risk (but also higher reward). So if the projects don’t do well (or go under), you will have a lower probability of recovering your investment.

Ownership

You don’t have a stake in the company so you are not involved in property management decisions or responsible for operational aspects.

Equity investments are higher risk (but also higher reward). So if the projects don’t do well (or go under), you will have a lower probability of recovering your investment.

Click the button above to see if you qualify for a debt or equity investment.

Click the button above to see if you qualify for a debt or equity investment.

How it works

Get accredited. Make your

investment. Get paid.

Ownership

First, you’ll need to create an account inside our investing portal. (Don’t worry – it only takes a few minutes!)

Get accredited

Next, you’ll get accredited. Within 48 hours, we’ll let you know if we can take on your investment

Select your

investment

Inside the portal, you can see the different investment opportunities and select the type of investment you’d like to make: equity or debt.

Make your investment

Once you’re ready, you can make your investment through the portal. Or if you prefer, you can wire us the money directly.

Get your distributions

If you’re a debt investor, you’ll wake up to money in your bank account* each month or quarter (depending on the deal structure). If you’re an equity investor, you’ll make money when we make a profit. *While we’ve never lost money on a deal, we can’t make any promises on the return you will make.

“Can’t I make more money investing on my own?” and other smart questions investors like you had before making money on autopilot

1. Can’t I make more money investing in real estate on my own?

Maybe. If you knew how to time the market juuuust right. And find the right properties in the right locations. But even then, you would have to invest a lot of time (and money) to make real estate investing profitable.

2. Ok… but how is this a better alternative to REITs?

For starters, you can make more money with us! The average annual return on REITs is 11.8%. With us, you can expect to make at least 12% and up to 18% for debt investments. And between 17-24% for equity investments.

3. What are the requirements to invest?

You must stay invested with renest capital for a minimum of 12 months. And you must invest a minimum of $50,000.

Get accredited

Prefer to meet us face to face before

making an investment?

Totally get it! Let’s hop on a Zoom call and get to know each other a bit. Or, if you’re in

the Miami area, we’d love to meet in person.

the Miami area, we’d love to meet in person.

What Our Valued

Customers Say

About renest capital

We’ve enjoyed 12%-15% returns from the initial investment (alteredFLIP) and will continue growing our portfolio with renest capital in the future. Tony continues to pour his professional experience into a category that needs authenticity – exactly the same one he’s demonstrating.