Putting your money to work for you – with data-driven real estate investing

How is renest capital different from other real estate funds?

Our team relies on decades of experience, data and extensive market research to pick (highly) profitable real

estate investments. So you can reap the profits – without doing any of the work.

estate investments. So you can reap the profits – without doing any of the work.

15+

Years Experience in

Real Estate

Real Estate

$24M

Assets Under

Management

25+

Investors

You want to know “do these people understand finance? Do they know how to manage my money?”

Short answer?

Yes. We do.

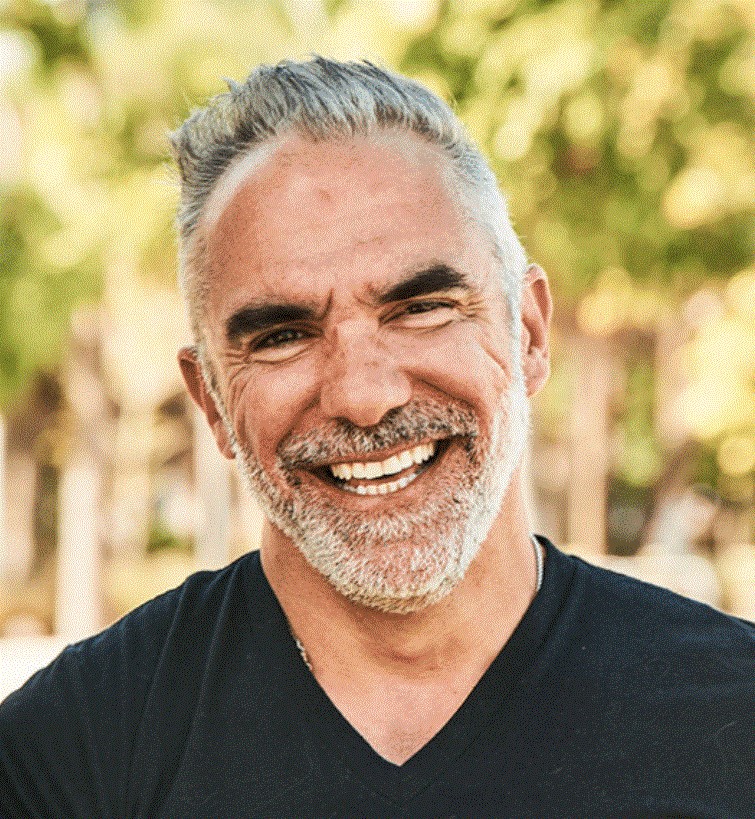

I’m Tony By The Way. Founder And CEO Of renest capital.

Before becoming a full-time real estate investor and fund manager, I worked in

the corporate world for over 25 years as a life sciences executive

In that role, I was responsible for managing multi-million dollar budgets and leading a

franchise within the overall business. I built a team. Created a work culture. Ensured my

team performed at a high level. And that the money we invested returned a profit.

During my time in the corporate world, I also:

Mastered accounting, financing and business. And dealt with P & L statements, pro forma sheets, balance statements, forecasting models and compensation plans

Was part of three major M & As in the pharmaceutical industry

Helped integrate two Fortune 100 companies – while preserving the people that drove performance

Built the sales team for a commercial franchise (and managed the legal, regulatory and compliance operations for the team)

Exited 3 companies in the corporate industry

I went on to get my degree from Brown University

And no, I’m not saying all that to blow my own trumpet…

My point is this: I take my job as a real estate fund manager seriously. I know how to manage money. And I know how to exit an investment profitably.

During my 15 years as a real estate investor and fund manager, I’ve learned how to maximize profit on a deal

I’ve seen some really smart investors aggressively go all in on a deal – and lose the asset.

Fortunately, my team and I have never lost money on a deal. But in the past, we did exit a few deals where we thought we would make a lot more money than we actually did.

Those experiences taught me the importance of balancing the conservative side with the aggressive.

So when we find the right deal, we RUN towards it. But before transacting, we make darn sure that the numbers we use to model that deal are conservative in nature.

For example, we always overestimate the costs involved in a project. Because our experience has shown us that things (almost) always cost more than you think.

We don’t follow the latest trends.

We follow the data.

We aren’t sheeps in a herd who blindly follow what other investors are doing. Instead, we look at where the market is going and follow the data.

We study the deals we’ve done and analyze data from several providers to help determine the profitability of asset classes in different regions. Based on that, we make logical (not emotional) investment decisions.

And that’s how we’ve been able to secure ROI for our investors. Every time.

Oh and one more thing you should know….

We care a lot about the people we do this for and with

To us, real estate investing isn’t just about the money.

It’s important that we make an impact on the new homeowners and surrounding neighborhood.

It’s important that we get along and find alignment with our stakeholders (in other words, we don’t do business with a-holes).

And it’s important that we maintain a close relationship with our investors (you).

So… are we a good fit?

Sounds like it!

Probably not

You are looking to invest in projects that have a positive impact on stakeholders and the surrounding neighborhood.

You don’t care about where your investment is going or who it is impacting.

You’re able to invest at least $50K

You aren’t able to invest $50K or more

You want to join a community of investors who care about what they do and who they do it with

You don’t care about joining a community of investors

You don’t want to make money on autopilot (you prefer to worry about the stock market ups and downs)

You don’t care about where your investment is going or who it is impacting.

Tap the button above to see if you qualify to make an investment